.Company Profile -

Srikalahasthi Pipes Limited (LIL) was incorporated on 1 November, 1991 by Lanco Group of Companies to manufacture Pig Iron and Cement. The installed capacity of Pig Iron was 90,000 TPA and with similar capacity 90,000 TPA for cement.

The company is engaged in engineering, procurement, and construction (EPC); and power, natural resources,infrastructure, and property development businesses. The company operates through five segments: EPC and Construction, Power, Property Development, Infrastructure, and Resources.

• The EPC and Construction segment provides EPC services for various projects, such as thermal and hydro power projects, chimneys, cooling towers and balance of plant, and transmission and distribution projects, as well as for roads, highways and bridges, metros and railways, buildings and airports, sea ports and marine structures, and water and pipeline facilities.

• The Power segment is engaged in generation and trading of power from thermal, hydro, wind, and solar sources.

• The Property Development segment develops integrated properties comprising commercial and

residential buildings.

• The Infrastructure segment is involved in the development of civil and urban projects, such as roads,

highways, ports, airports, railway lines, etc. on build, operate, and transfer basis. The Resources segment is engaged in the exploration, mining, and marketing of coal.

• The company is also involved in the construction of water supply and irrigation projects, including dam,tunnels, etc.

Why to buy?

1. Future looks promising -

India is expected to become the second-largest steel producer in the world by 2016. Easy availability of low-cost manpower and presence of abundant iron ore reserves make India competitive in the global setup.

2. Industry to revive -

Since government of India focusing more on civil and urban projects and lanco being major player in the south India will likely to benefit in a big way from such projects. Further, company is able to reduce debt to equity ratio from 2.21 to 1.8 this fiscal year which is likely to improve southwards further to 1.5 in FY15. Net margin will likely to be around 6-7% in FY15 from current 4% which is showing healthy improvement in bottom line.

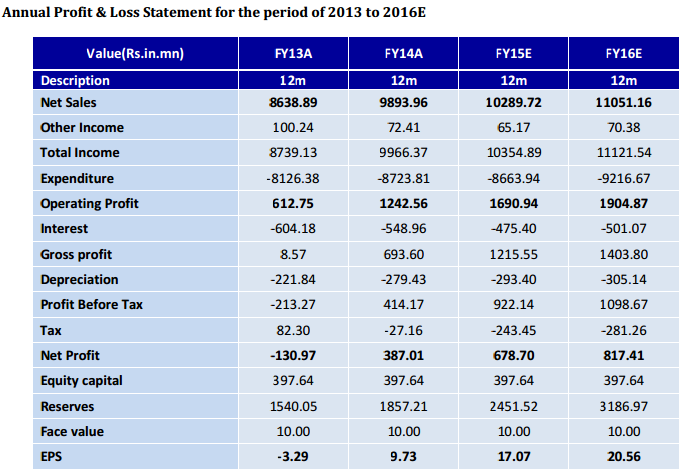

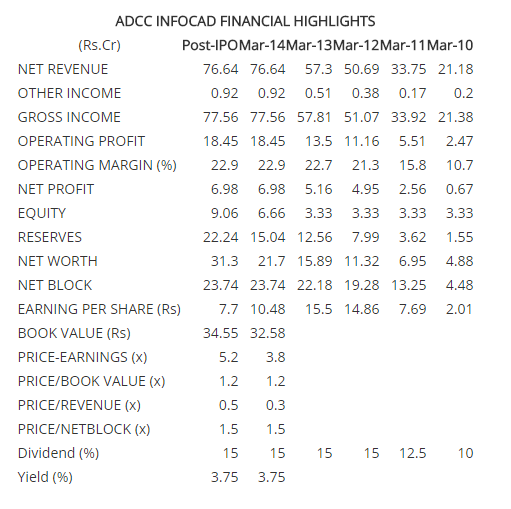

At the current market price of Rs. 72.40, the stock P/E ratio is at 4.24 x FY15E and 3.52 x FY16E respectively. Earnings per share (EPS) of the company for the earnings for FY15E and FY16E are seen at Rs. 17.07 and Rs. 20.56 respectively. Hence, we recommend to buy the stock on any decline from CMP for the target of 110 in medium to long term.

Srikalahasthi Pipes Limited (LIL) was incorporated on 1 November, 1991 by Lanco Group of Companies to manufacture Pig Iron and Cement. The installed capacity of Pig Iron was 90,000 TPA and with similar capacity 90,000 TPA for cement.

The company is engaged in engineering, procurement, and construction (EPC); and power, natural resources,infrastructure, and property development businesses. The company operates through five segments: EPC and Construction, Power, Property Development, Infrastructure, and Resources.

• The EPC and Construction segment provides EPC services for various projects, such as thermal and hydro power projects, chimneys, cooling towers and balance of plant, and transmission and distribution projects, as well as for roads, highways and bridges, metros and railways, buildings and airports, sea ports and marine structures, and water and pipeline facilities.

• The Power segment is engaged in generation and trading of power from thermal, hydro, wind, and solar sources.

• The Property Development segment develops integrated properties comprising commercial and

residential buildings.

• The Infrastructure segment is involved in the development of civil and urban projects, such as roads,

highways, ports, airports, railway lines, etc. on build, operate, and transfer basis. The Resources segment is engaged in the exploration, mining, and marketing of coal.

• The company is also involved in the construction of water supply and irrigation projects, including dam,tunnels, etc.

Why to buy?

1. Future looks promising -

India is expected to become the second-largest steel producer in the world by 2016. Easy availability of low-cost manpower and presence of abundant iron ore reserves make India competitive in the global setup.

2. Industry to revive -

Since government of India focusing more on civil and urban projects and lanco being major player in the south India will likely to benefit in a big way from such projects. Further, company is able to reduce debt to equity ratio from 2.21 to 1.8 this fiscal year which is likely to improve southwards further to 1.5 in FY15. Net margin will likely to be around 6-7% in FY15 from current 4% which is showing healthy improvement in bottom line.

At the current market price of Rs. 72.40, the stock P/E ratio is at 4.24 x FY15E and 3.52 x FY16E respectively. Earnings per share (EPS) of the company for the earnings for FY15E and FY16E are seen at Rs. 17.07 and Rs. 20.56 respectively. Hence, we recommend to buy the stock on any decline from CMP for the target of 110 in medium to long term.